Luke Cross, Director at Social, chaired discussions at the recent Treasury in Housing event to help guide conversations to drive positive change in the evolving landscape of social housing finance. Here are his key takeaways:

- Some positivity around the support housing has in central government – but the importance of rebuilding trust in the sector and continuing to lobby for a long-term strategy for housing.

- Consensus from most speakers that the social housing sector’s funding model isn’t broken – but that it’s certainly creaking…

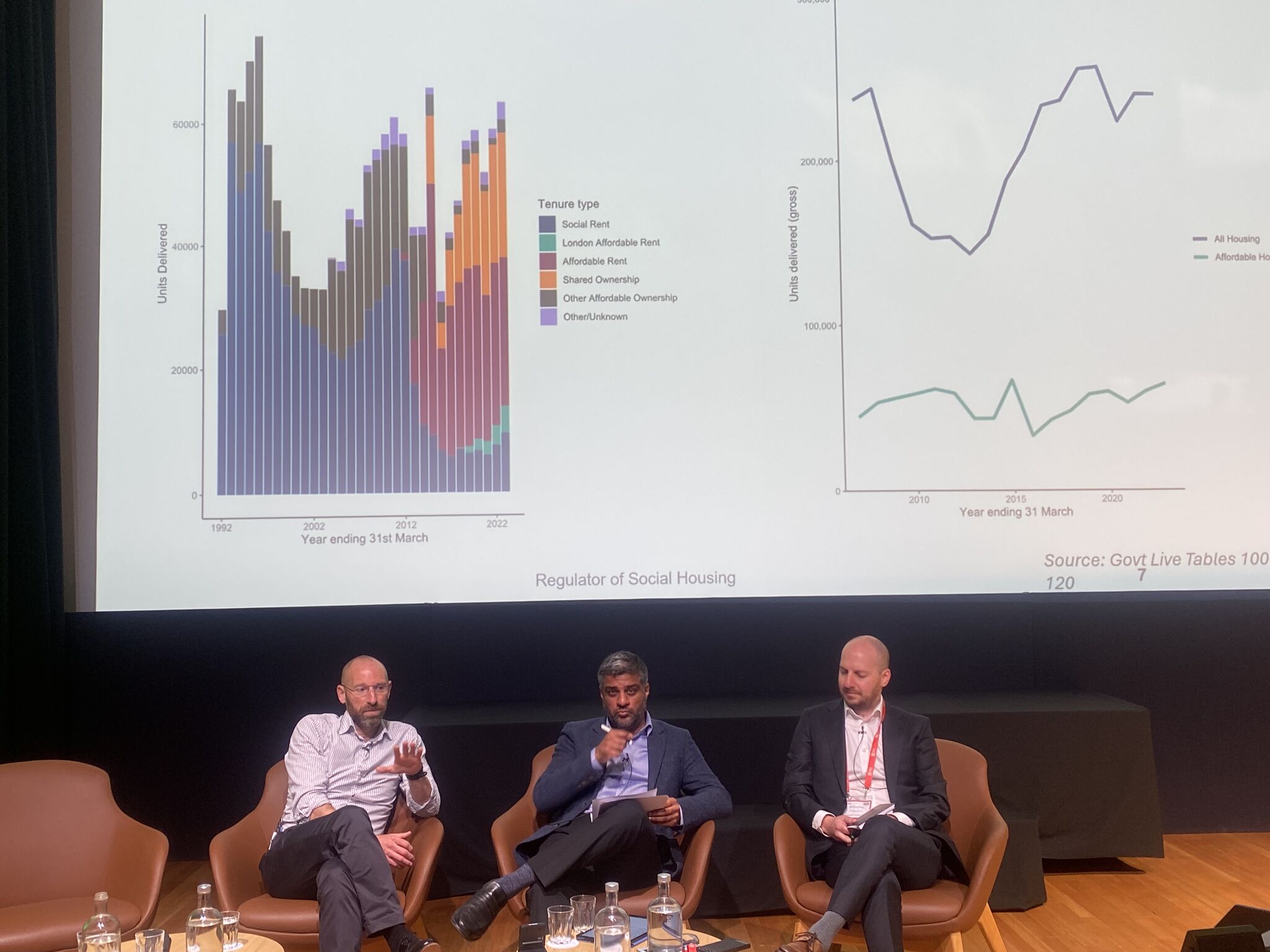

- The idea that there is financial capacity in the sector – but that it may not be in the right places to match the specific housing need. Fundamentals like interest cover are worse than a number of business plans have forecast – so is the sector getting it right on business planning…?

- But then encouraging messages from rating agencies and funders about the underlying credit of the sector, even in hard times – with one agency suggesting A is where it’ll stay, and a survey of attendees suggesting most HAs will remain in the A or BBB credit range. We also heard about a 10-15 bps pricing ratchet linked to ratings downgrades. And also the inevitability of ratings pressure for those big HAs stepping in on rescues of some smaller to medium sized providers – of which we expect to see more in future…

- The power of funding partnerships – and how treating housing as infrastructure can open up a new range of funding mechanisms and options.

- I was pleased to chair a discussion about bringing residents and housing finance closer together – and the value in promoting greater transparency around the way housing providers are funded. One message was to be clear about the ‘why’ and understanding what residents want to know, not just what HAs think residents should know.

- Plenty of messages of support from the funding community. With merger and rationalisation expected to continue, there seemed to be signs of a mature HA/lender relationship that puts the days of repricing for repricing’s sake behind us…allegedly…

- While capital grant was understandably voted as the most important enabler for new homes delivery by the audience, there was a call for a joined up discussion about the role of grant, rents, debt and equity when taken together. What can/should a strengthened funding regime look like – and given there is ‘plenty of housing crisis to go around’, isn’t it essential we welcome more participants, partnerships and forms of capital…?

- The final panel finished on an optimistic note – we’re entering a new era with social housing top of the political agenda, and with a government that sees housing as essential to economic growth.

Looking ahead

As Luke emphasises, the event is an opportunity to “share best practice and hear from those doing great work.” These conversations are not just about surviving today’s challenges—they’re about building resilience and securing a stable financial future for housing providers.

In times of uncertainty, coming together to pool knowledge and experiences is more important than ever.